snohomish property tax rate

Box 1589 Snohomish WA 98291-1589. Snohomish WA 98291-1589 Utility Payments PO.

Snohomish County Home Values Soar In Latest Assessment Heraldnet Com

Snohomish County Treasurer 3000 Rockefeller.

. Box 1589 Snohomish WA 98291-1589 Report a Problem after-hours 360 563-2012 Non-police related. The first half taxes are due April 30th 2022. The median property tax on a 33860000 house is 301354 in Snohomish County The median property tax on a 33860000 house is 311512 in Washington The median property tax on a 33860000 house is 355530 in the United States.

Are Snohomish County property taxes delayed. The Snohomish Washington sales tax is 910 consisting of 650 Washington state sales tax and 260 Snohomish local sales taxesThe local sales tax consists of a 260 city sales tax. Accounts with delinquent taxes must first be approved by the Snohomish County Treasurers Office.

The median annual property tax in Snohomish County is 3615 second-highest in the state and. You will find a great deal of information available to you here including access to property information exemption forms property tax related RCWs our SCOPI mapping tool etc. Property Taxes by State.

The states average effective rate is 242 of a homes value compared to the national average of 107. Start Your Homeowner Search Today. The 2022 property tax statements should be received by taxpayers in mid-February.

Explore important tax information of Snohomish. Tax Timber Tax Total Tax CITY OF EVERETT EVERETT 21040865174. Snohomish WA 98291-1589 Utility Payments PO.

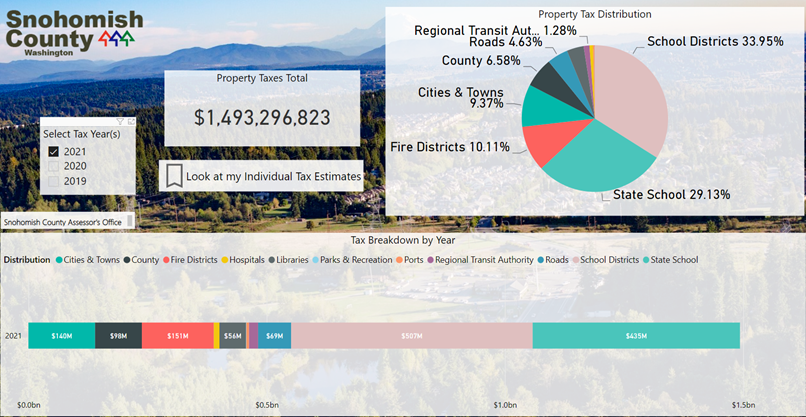

Property taxes for all purposes will total 1493 billion in 2021 up 881 thousand over 2020s 1492 billion that was levied for all. Assessor Annual Reports for Taxes. EVERETT Snohomish County March 30 2020 Due to the financial hardships caused by the COVID-19 pandemic Snohomish County Treasurer Brian Sullivan and Executive Dave Somers have extended the first-half 2020.

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. 2022 taxes are available to view or pay online here. Personal Property Tax Rate 1120 per 1000 of assessed value at 100 of market value.

Snohomish County Government 3000 Rockefeller Avenue Everett WA. Groceries are exempt from the Snohomish and Washington state sales taxes. Snohomish County The Department of Revenue oversees the administration of property taxes at state and local levels.

No call is required for payment of current year taxes. Welcome to the Snohomish County Assessors Office Website. Such As Deeds Liens Property Tax More.

The Snohomish Sales Tax is collected by the merchant on all qualifying sales made within Snohomish. The Annual Report is a good resource for property tax information such as the amount of taxes the districts will collect the total assessed value for each district the tax rate for each levy or TCA as well as other statistics about Snohomish County that you may find helpful. The Treasurer calculates the taxes due and sends out the tax notices using the taxing district information.

In our oversight role we conduct reviews of county processes and procedures to ensure compliance with state statutes and regulations. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs. Property taxes to be collected this year by all taxing districts in Snohomish County will show an overall 006 increase over last year.

Please call 425-388-3606 if you would like to make payments on your DELINQUENT property Taxes. For more information please visit the web pages of Snohomish Countys Assessor and Treasurer or look up this propertys current valuation and tax situation. I encourage you to explore the tabs and buttons on the top and bottom of this page.

The median property tax also known as real estate tax in Snohomish County is 300900 per year based on a median home value of 33860000 and a median effective property tax rate of 089 of property value. Search Valuable Data On A Property. Ad Find Out the Market Value of Any Property and Past Sale Prices.

Some Snohomish County towns will experience double digit increase with Marysville being the. The assessed value of your property is multiplied by the tax rate necessary in your levy area to produce your fair share of the total levied tax by these jurisdictions. Overall homeowners pay the most property taxes in New Jersey which has some of the highest effective tax rates in the country.

Send your check or money order to. Ad Get In-Depth Property Tax Data In Minutes. District Levy Regular Value Excess Value Timber Value Rate Real Pers.

Snohomish County Treasurer Updates.

Redefy Real Estate Housing News 8 15 16 Nar National Average For Real Estate Real Estate Realtors Home Buying

Graduated Real Estate Tax Reet For Snohomish County

Guide To Buying An Investment Property In Snohomish Wa

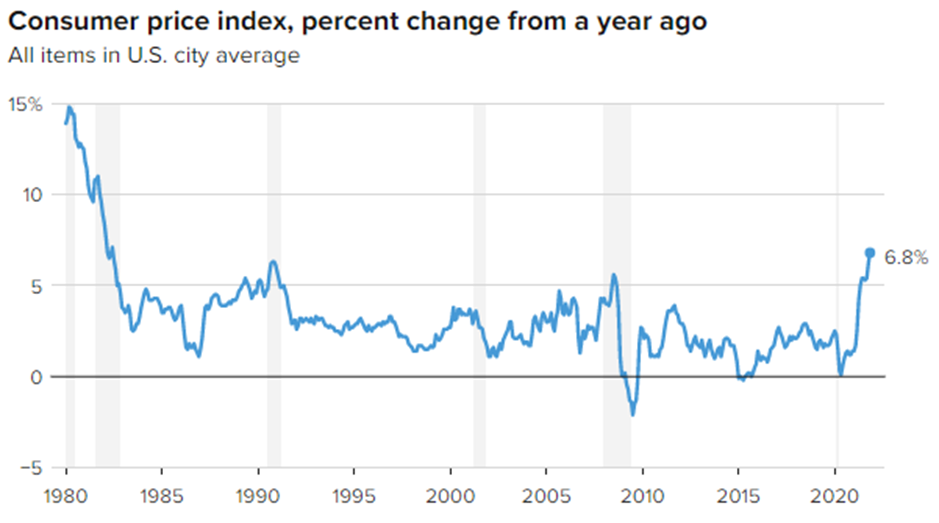

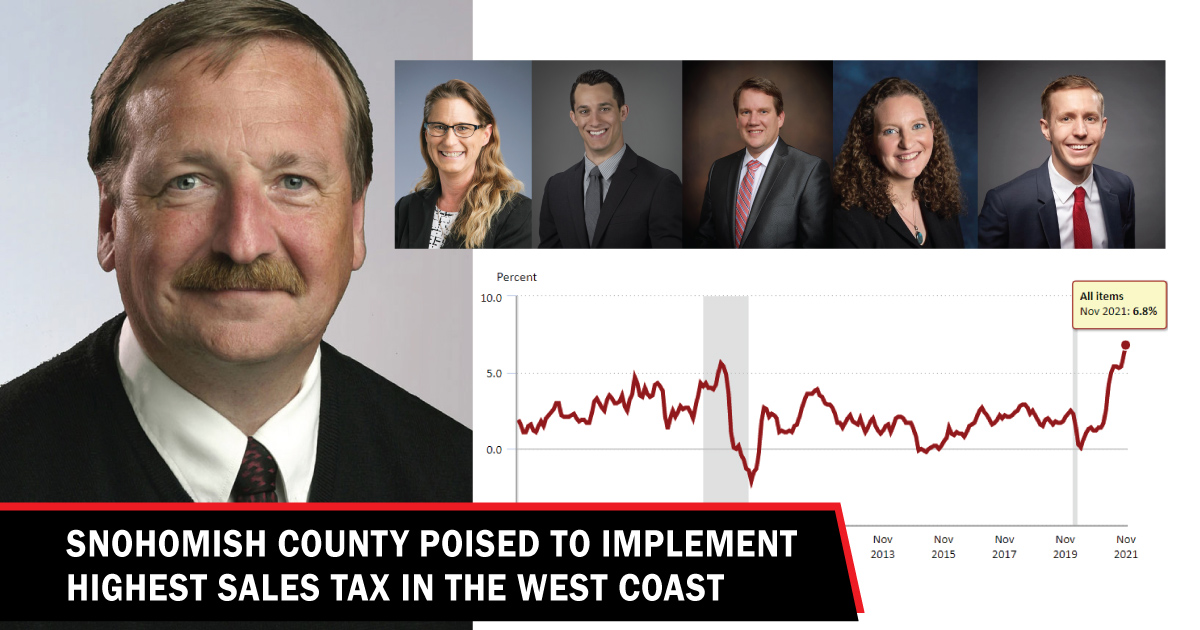

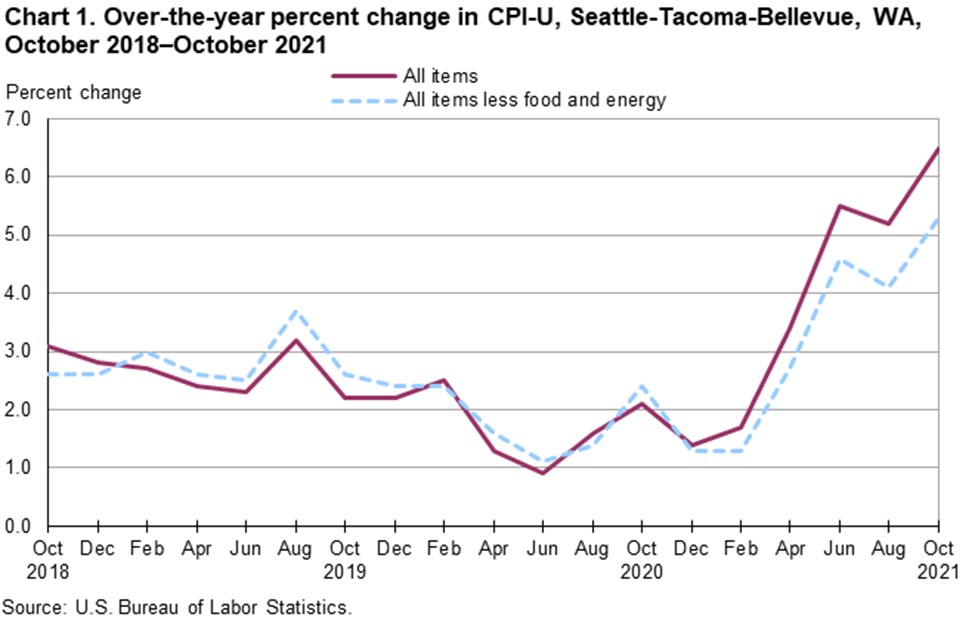

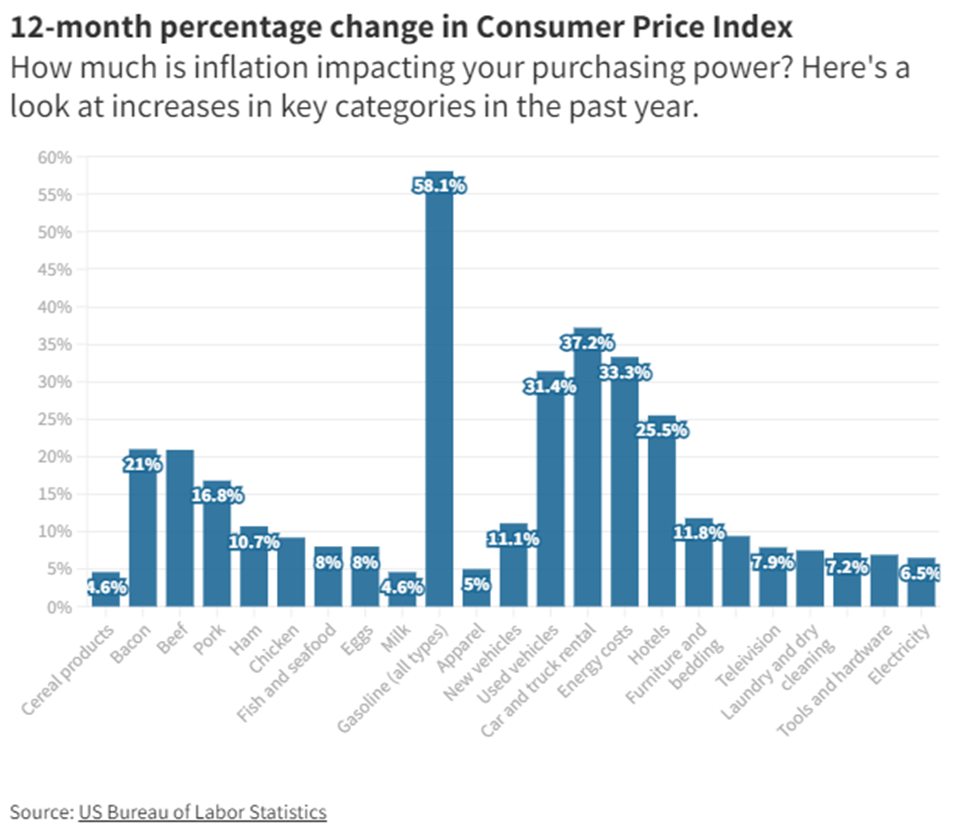

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Pin On Homes For Sale In Snohomish County

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

News Flash Snohomish County Wa Civicengage

How To Read Your Property Tax Statement Snohomish County Wa Official Website

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Area Briefly Snohomish County Tax Statement To Be Mailed Soon News Goskagit Com

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Charming River Rock Fireplaces Craftsman House Rock Fireplaces

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Mountlake Terrace City Council Approves Property Tax Increase Code Updates Mltnews Com

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times